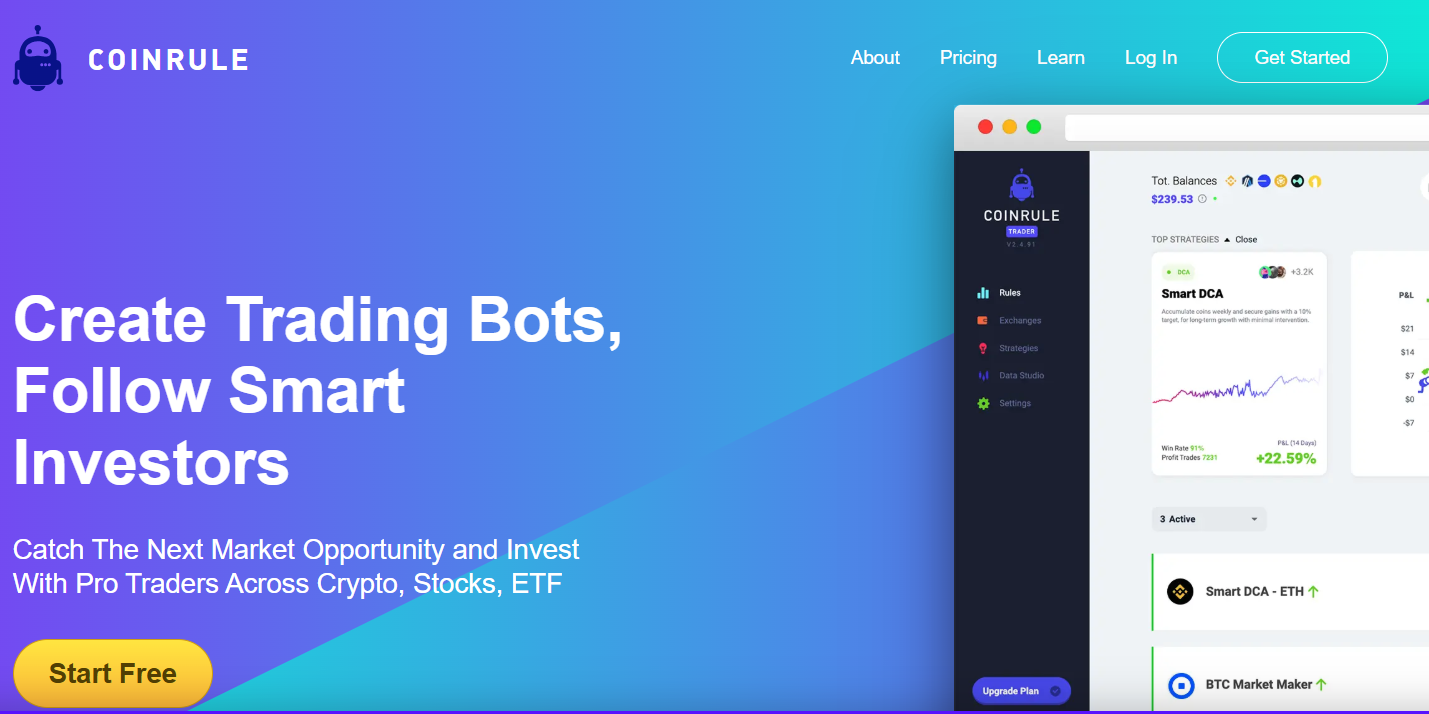

Coinrule Review (2026): Pricing, Features, Pros & Cons – Is It Worth It?

What Is Coinrule?

4

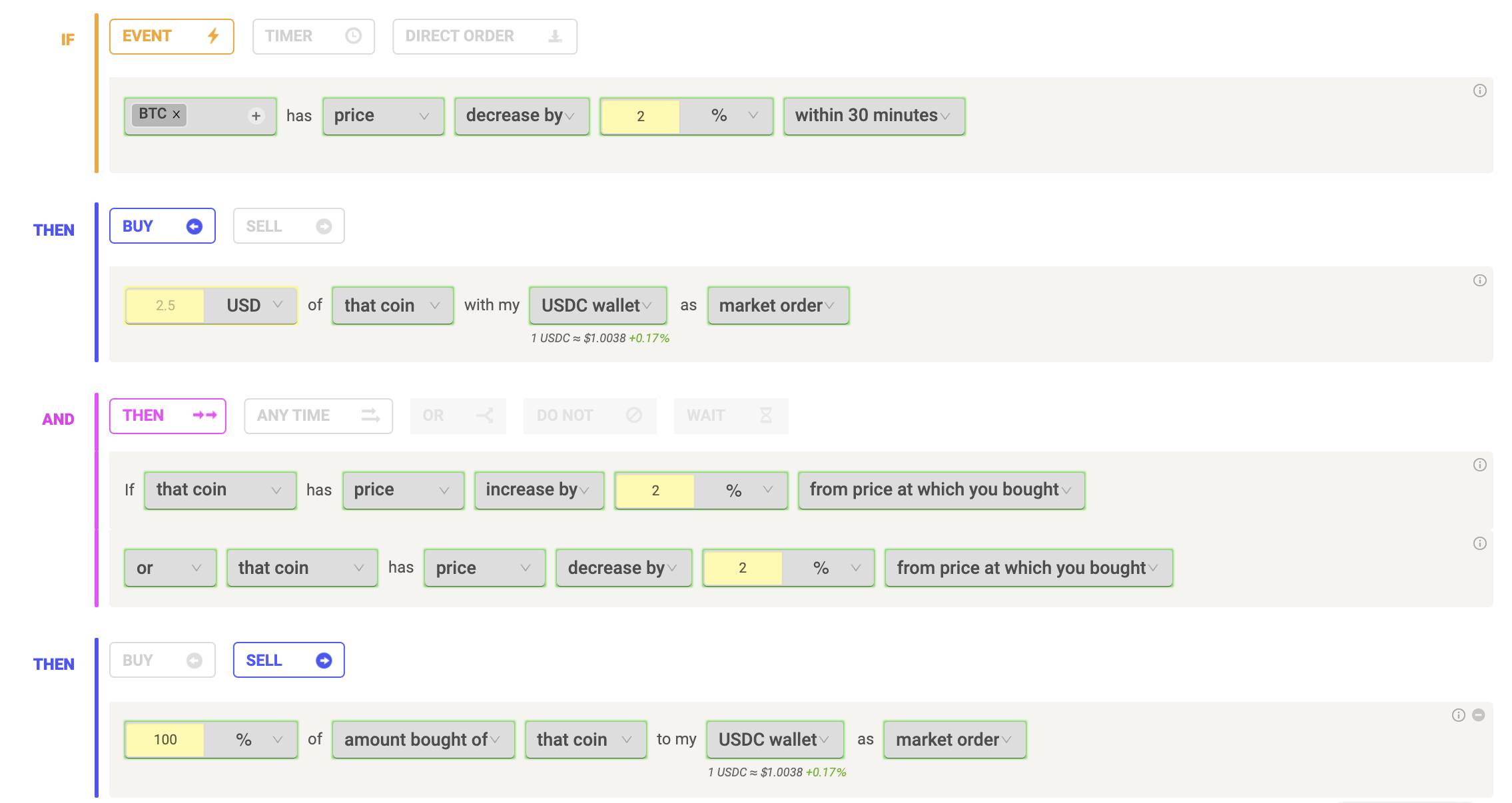

Coinrule is a cloud-based crypto trading automation platform that allows users to create “IF–THEN” rule-based strategies without writing code.

Instead of building complex trading bots in Python, you simply define logic like:

-

IF Bitcoin drops 5% within 24 hours → THEN buy

-

IF RSI crosses above 30 → THEN open position

-

IF profit reaches 10% → THEN sell

The system connects to supported exchanges via API keys and executes trades automatically on your behalf.

Who Should Use Coinrule?

-

Retail crypto traders

-

Swing traders

-

Momentum traders

-

Busy professionals who can’t monitor charts 24/7

-

Traders who want emotional discipline

Who It’s Not Ideal For

-

High-frequency traders

-

Institutional quant desks

-

Users who require millisecond execution

-

Complete beginners with no trading knowledge

If you want to see how the interface works and explore available strategy templates, you can check out Coinrule’s official platform here.

Why Coinrule Matters in 2026

Crypto markets in 2026 are increasingly automated.

Key trends:

-

Algorithmic participation is rising

-

Market reactions happen faster

-

More traders compete for the same signals

-

Emotional mistakes cost more

Manual trading often leads to:

-

Panic selling

-

Overtrading

-

Late entries

-

Ignoring stop-losses

Automation removes emotion.

By predefining logic, Coinrule ensures trades execute based on rules — not fear or greed.

For traders serious about structure and consistency, exploring Coinrule’s automation system can be a practical step toward disciplined execution.

Key Features

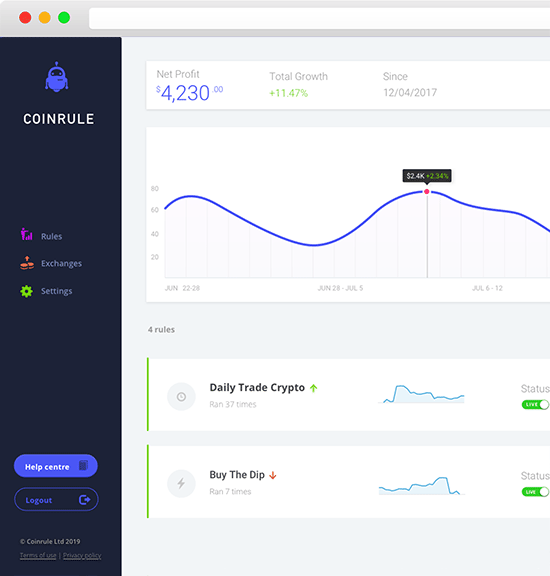

1. No-Code Strategy Builder

4

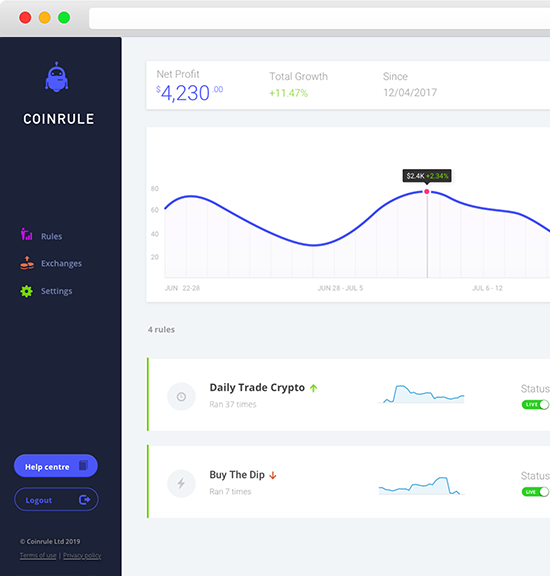

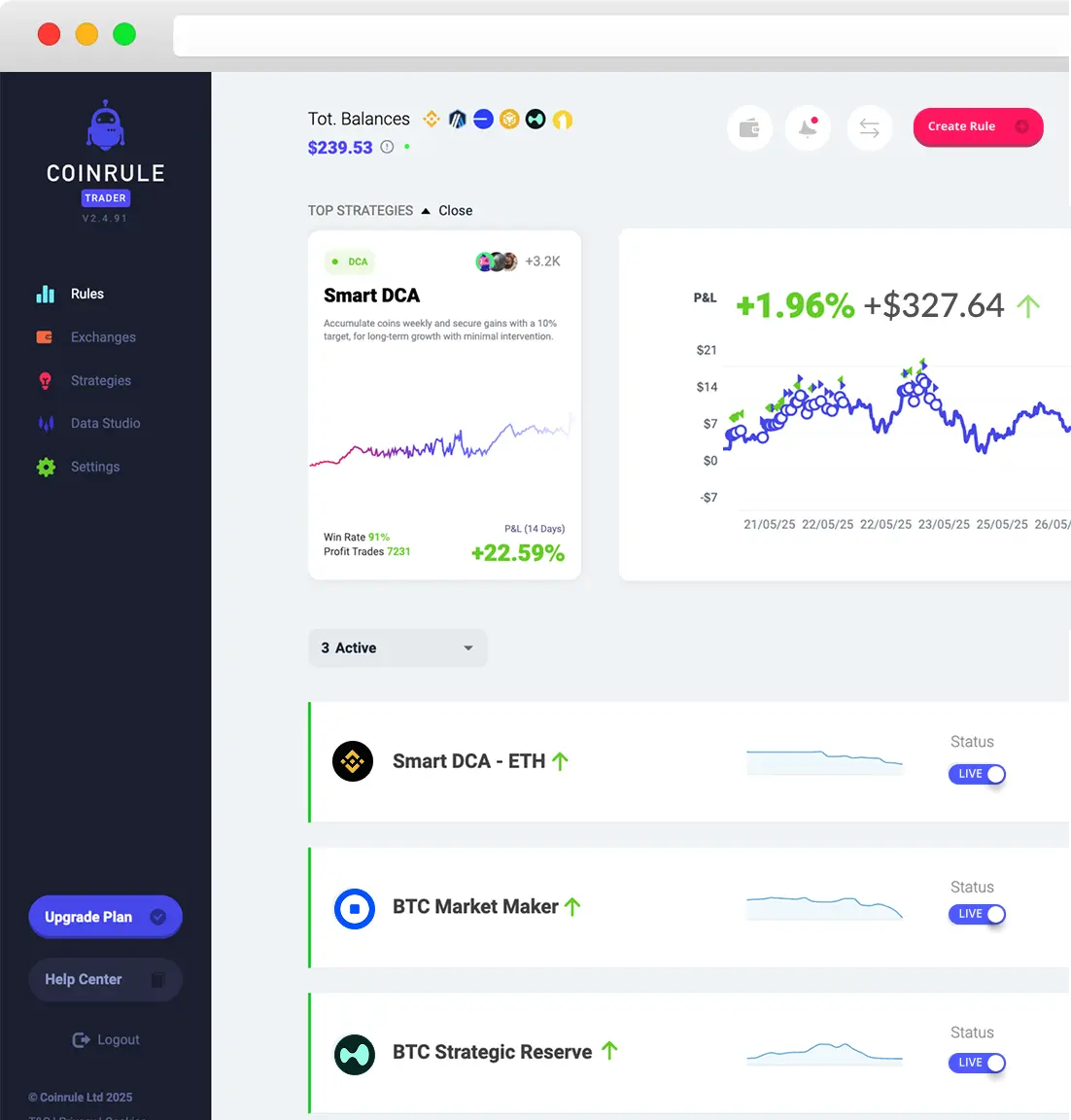

The core of Coinrule is its visual rule builder.

You can:

-

Set market conditions

-

Define entry triggers

-

Automate take-profit and stop-loss

-

Allocate capital percentages

-

Combine multiple conditions

No coding required.

Why It Matters

Most algorithmic platforms require scripting knowledge. Coinrule lowers the barrier to entry and allows traders to focus on strategy rather than programming.

2. Pre-Built Strategy Templates

Coinrule includes ready-made templates for:

-

Breakout strategies

-

Accumulation strategies

-

Trend-following setups

-

Volatility triggers

-

Stop-loss automation

These templates help:

-

Beginners get started faster

-

Experienced traders modify proven logic

-

Users test ideas without building from scratch

3. Exchange Integration

Coinrule integrates with major crypto exchanges via API.

Important:

Your funds remain on your exchange account. Coinrule does not hold custody of your crypto.

This reduces counterparty risk and keeps asset control in your hands.

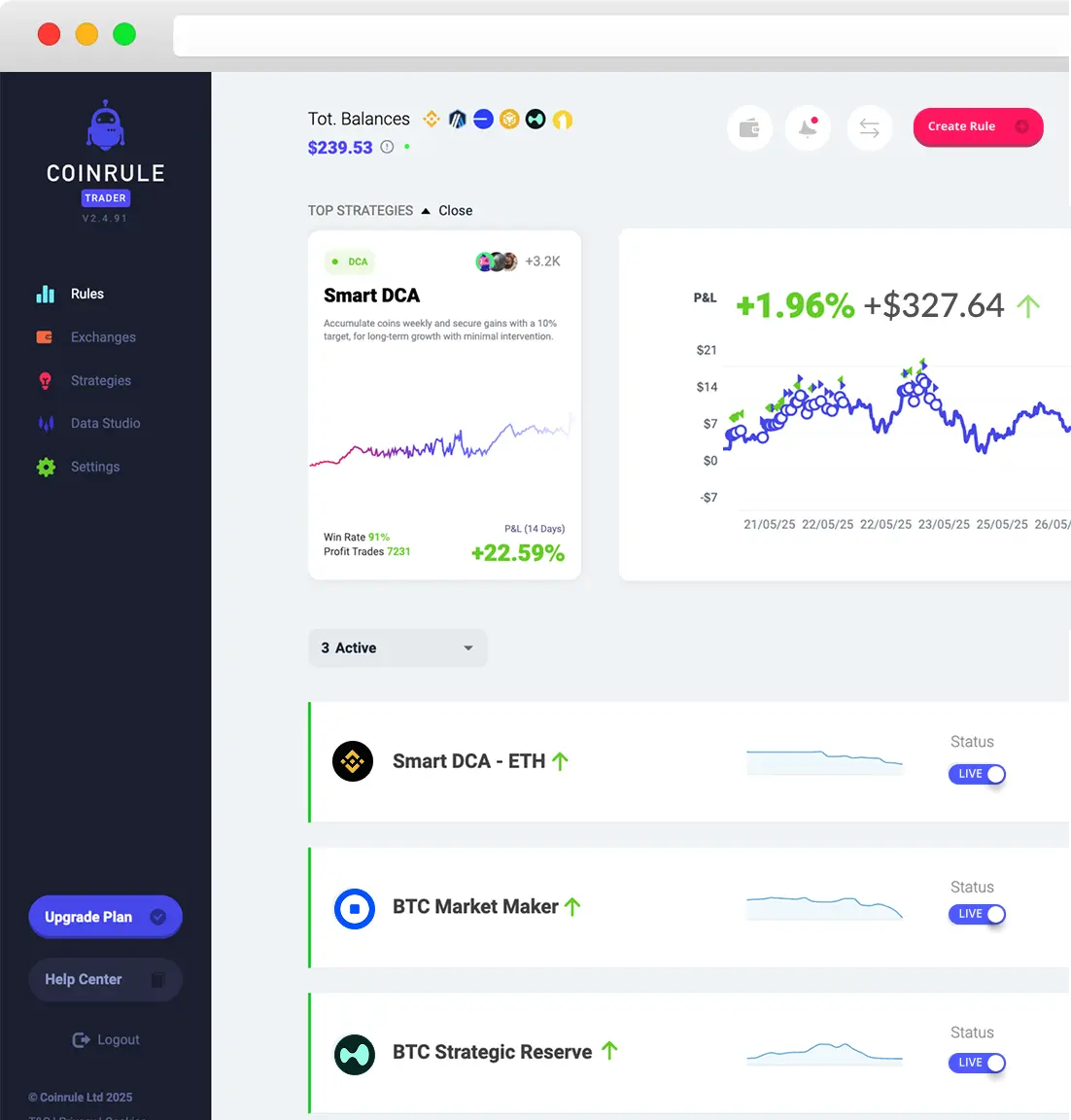

4. Backtesting & Demo Modes

4

Depending on your plan, Coinrule offers backtesting and demo trading functionality.

This allows you to:

-

Simulate strategies

-

Review historical performance

-

Adjust risk parameters

-

Improve logic before going live

While not institutional-grade quantitative modeling, it provides practical validation for retail traders.

5. Risk Management Controls

You can define:

-

Stop-loss conditions

-

Profit targets

-

Capital allocation per trade

-

Frequency limits

Risk control is often more important than entry signals. Coinrule allows structured risk planning instead of reactive decision-making.

Real-World Benefits

Emotional Discipline

Automation enforces your rules consistently.

No panic. No revenge trading. No impulsive overrides.

Time Efficiency

Instead of watching charts all day:

-

Set rules once

-

Let the system monitor 24/7

-

Focus on research and strategy

For working professionals, this is a major advantage.

Consistency & Scalability

Managing multiple exchange accounts manually is difficult. Coinrule centralizes automation and makes strategy replication easier.

Potential ROI Impact

While no platform guarantees profits, structured automation can:

-

Reduce emotional losses

-

Improve execution timing

-

Maintain disciplined exits

-

Support systematic growth

Pricing & Value Analysis

Coinrule offers multiple subscription tiers, including a limited free version and paid plans that unlock:

-

More live rules

-

Additional exchange connections

-

Advanced indicators

-

Backtesting features

Since pricing structures can change, it’s best to review the current plans directly.

👉 You can see the latest pricing breakdown on Coinrule’s official website here.

Is It Worth It?

If automation:

-

Prevents one major emotional mistake

-

Improves execution consistency

-

Saves hours each week

-

Enhances structured risk control

Then the subscription cost can justify itself quickly for active traders.

Pros & Cons

Pros

-

No coding required

-

Beginner-friendly interface

-

Strategy templates available

-

Secure API-based execution

-

Funds remain on exchange

-

Good balance between flexibility and usability

Cons

-

Not suitable for high-frequency trading

-

Limited compared to fully custom-coded bots

-

Subscription cost may be high for small portfolios

-

Performance depends entirely on your strategy

Who Should Use Coinrule?

Best For

-

Retail crypto traders

-

Swing and momentum traders

-

Busy professionals

-

Traders seeking emotional discipline

-

Users interested in automation without programming

Not Ideal For

-

Institutional trading desks

-

HFT strategies

-

Traders requiring ultra-low latency

-

Users with no understanding of trading basics

Final Verdict: Is Coinrule Worth It in 2026?

Coinrule sits between simplicity and power.

It’s not a guaranteed-profit system.

It’s not a high-frequency trading engine.

What it does offer is structured automation, discipline, and accessibility for retail traders who want to execute strategies consistently.

If you already have trading logic and want to remove emotion from execution, Coinrule can be a valuable tool.

👉 Start exploring Coinrule’s automation platform here:

Access Coinrule’s official website

FAQ (Buyer Intent Optimized)

Is Coinrule legit?

Yes. It operates through API integration with major exchanges and does not hold user funds.

Does Coinrule guarantee profits?

No. It executes predefined strategies. Results depend entirely on your trading logic and market conditions.

Does Coinrule offer a free plan?

Yes, a limited free version is typically available, with paid plans offering expanded functionality.

Is Coinrule safe?

Security depends on proper API configuration. Users maintain custody of funds on their exchange accounts.

Is Coinrule better than coding your own bot?

For non-programmers, yes. For advanced developers, custom bots offer deeper flexibility.

Can beginners use Coinrule?

Yes, but users should still understand basic trading principles before automating strategies.

What exchanges does Coinrule support?

Coinrule integrates with major crypto exchanges (availability may vary by region).

Is Coinrule suitable for long-term investing?

It is primarily designed for active trading strategies rather than passive holding.

RELATED REVIEWS

PagerGPT Review