Kavout Review: A Detailed Look at This AI Stock Analysis Tool

What Is Kavout?

4

Kavout is an AI-driven stock analysis and investment research platform designed to help investors make data-backed decisions using machine learning models.

Instead of manually analyzing financial statements, earnings reports, and technical indicators, Kavout uses artificial intelligence to:

-

Rank stocks based on predictive scoring

-

Identify growth opportunities

-

Analyze risk metrics

-

Provide data-driven insights

-

Support portfolio strategy decisions

For retail investors who want institutional-level analytics without building complex spreadsheets, Kavout positions itself as a smarter alternative.

If you want to explore its plans and features directly, you can check them here:

👉 Explore Kavout pricing and features

Why AI Matters in Investing in 2026

The stock market is more data-heavy than ever.

Retail investors now compete with:

-

Hedge funds

-

Quant trading firms

-

Algorithmic strategies

-

High-frequency traders

Traditional research methods alone may not be enough.

AI-powered investing tools like Kavout aim to:

-

Process massive datasets instantly

-

Identify hidden patterns

-

Reduce emotional bias

-

Support data-backed decisions

While AI does not guarantee profits, it can improve structured decision-making.

👉 See how Kavout uses AI for stock insights

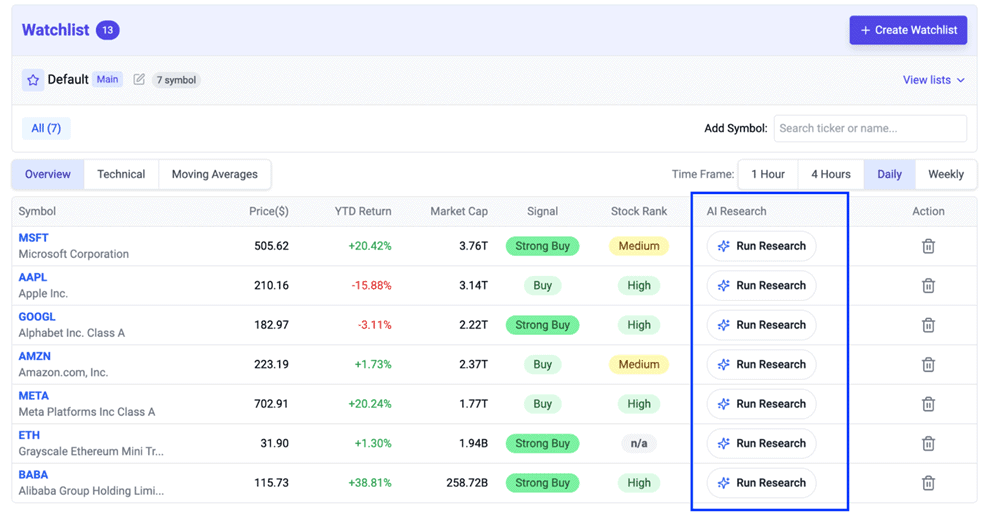

Key Features of Kavout

1. AI-Powered Stock Ranking System

4

One of Kavout’s standout features is its AI-driven stock ranking system.

It analyzes:

-

Financial fundamentals

-

Market sentiment

-

Technical indicators

-

Historical performance

-

Risk patterns

The result is a predictive scoring model designed to help investors quickly identify potentially strong-performing stocks.

Instead of scanning hundreds of companies manually, investors can focus on top-ranked opportunities.

If you want to see how the ranking model works,

👉 Check Kavout’s plan options here

2. Portfolio Analytics & Risk Insights

Kavout provides tools to evaluate:

-

Portfolio allocation

-

Risk exposure

-

Volatility trends

-

Sector diversification

This helps investors understand whether their portfolio is:

-

Overexposed to one sector

-

Too volatile

-

Under-diversified

Data clarity often reduces emotional decision-making.

3. Data-Driven Market Signals

4

Kavout offers market signals powered by data analysis.

These signals help investors:

-

Spot trend changes

-

Identify breakout opportunities

-

Monitor stock momentum

-

Evaluate relative strength

For active investors, this can provide faster reaction times compared to manual chart review.

👉 Explore Kavout’s AI insights here

4. Institutional-Level Data Access

Retail investors often lack access to institutional-grade analytics.

Kavout bridges that gap by providing:

-

Quantitative metrics

-

Machine learning models

-

Predictive analysis tools

-

Performance backtesting

While no AI tool can eliminate risk, structured analytics improve decision quality.

Real Benefits of Using Kavout

Here’s where Kavout can add real value:

✔ Saves research time

✔ Reduces emotional trading

✔ Surfaces hidden opportunities

✔ Helps structure portfolio strategy

✔ Makes data more accessible

For investors who actively research stocks weekly, this tool can significantly streamline workflow.

👉 View Kavout pricing plans here

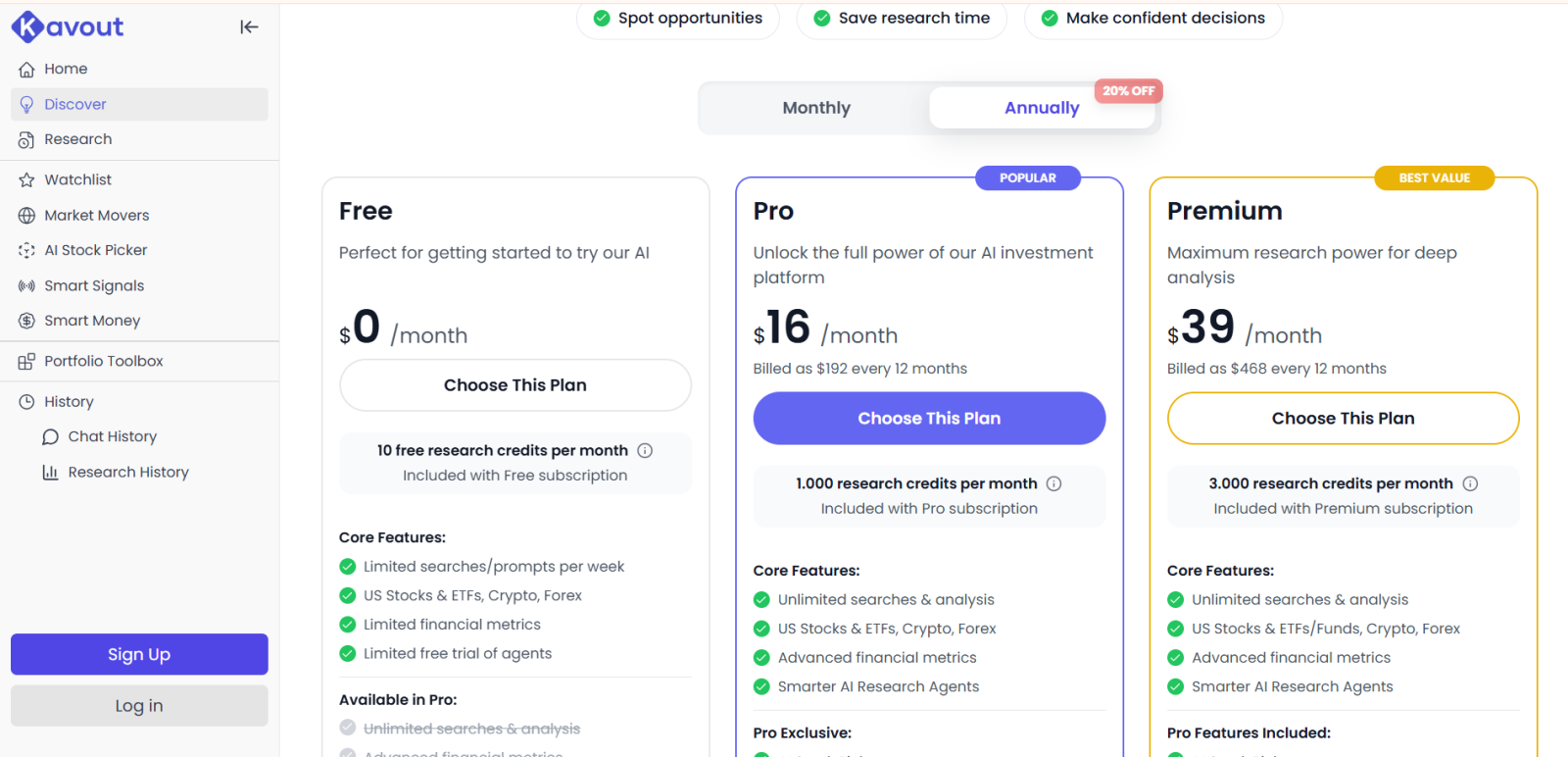

Kavout Pricing: Is It Worth the Investment?

Kavout offers tiered pricing plans based on access level and features.

Before considering cost, ask:

-

How much time do you spend researching weekly?

-

Are you making data-driven or emotional decisions?

-

Would structured AI insights improve your strategy?

If AI-supported analysis helps avoid even one major mistake or spot one strong opportunity, the subscription may justify itself.

You can review the latest pricing breakdown here:

👉 See Kavout pricing plans

Pros and Cons

Pros

-

AI-driven stock ranking

-

Data-heavy analytics

-

Portfolio risk evaluation

-

Designed for serious investors

-

Structured decision support

Cons

-

Not beginner hand-holding

-

Requires understanding of investing basics

-

Does not guarantee profits

Who Should Use Kavout?

Ideal for:

✔ Active retail investors

✔ Data-driven traders

✔ Long-term portfolio managers

✔ Investors seeking AI support

Not ideal for:

✖ Complete beginners with no investing knowledge

✖ Passive investors who never analyze stocks

If you value structured analysis over speculation, Kavout can be worth exploring.

👉 Start exploring Kavout today

Final Verdict: Is Kavout Worth It in 2026?

AI is increasingly becoming part of modern investing.

Kavout does not promise guaranteed returns.

Instead, it offers:

-

Structured analysis

-

Predictive scoring

-

Portfolio clarity

-

Data-driven insights

For serious investors who want an analytical edge, Kavout is a powerful research assistant.

👉 Check Kavout plans and start analyzing smarter

Frequently Asked Questions (FAQ)

1. What is Kavout used for?

Kavout is an AI-powered stock analysis and research platform.

2. Does Kavout guarantee profits?

No. It provides data-driven insights but does not guarantee returns.

3. Is Kavout suitable for beginners?

It’s better suited for investors with basic market knowledge.

4. How does Kavout rank stocks?

It uses machine learning models analyzing financial, technical, and sentiment data.

5. Can I manage my portfolio inside Kavout?

Yes, portfolio analytics and risk insights are included.

6. Is Kavout better than manual research?

It speeds up data processing but should complement, not replace, judgment.

7. Does Kavout offer different pricing plans?

Yes, tiered plans are available depending on features.

8. Is Kavout good for long-term investing?

Yes, especially for structured data-driven strategies.

9. Can AI replace financial advisors?

AI tools assist but do not replace professional advice.

10. Is Kavout worth the cost?

If AI insights improve your decision-making process, it can justify its pricing.

RELATED REVIEWS

PagerGPT Review