Kavout Review : Can AI Really Help You Beat the Stock Market? 4

Kavout Review (2026): Can AI Really Help You Beat the Stock Market?

4

Artificial intelligence is transforming investing.

From hedge funds to retail traders, AI-driven models are now being used to analyze:

-

Market trends

-

Financial statements

-

Price momentum

-

Risk factors

-

Institutional flows

One of the platforms bringing AI-powered investing tools to everyday investors is Kavout.

But the real question is:

Is Kavout actually useful — or just another overhyped AI tool?

In this in-depth review, we’ll break down:

-

What Kavout does

-

How its AI stock ratings work

-

Key features and tools

-

Pricing plans

-

Pros and cons

-

Whether it’s worth it in 2026

If you're curious how AI can support your investing decisions, you can explore Kavout pricing plans here and see which subscription tier fits your strategy.

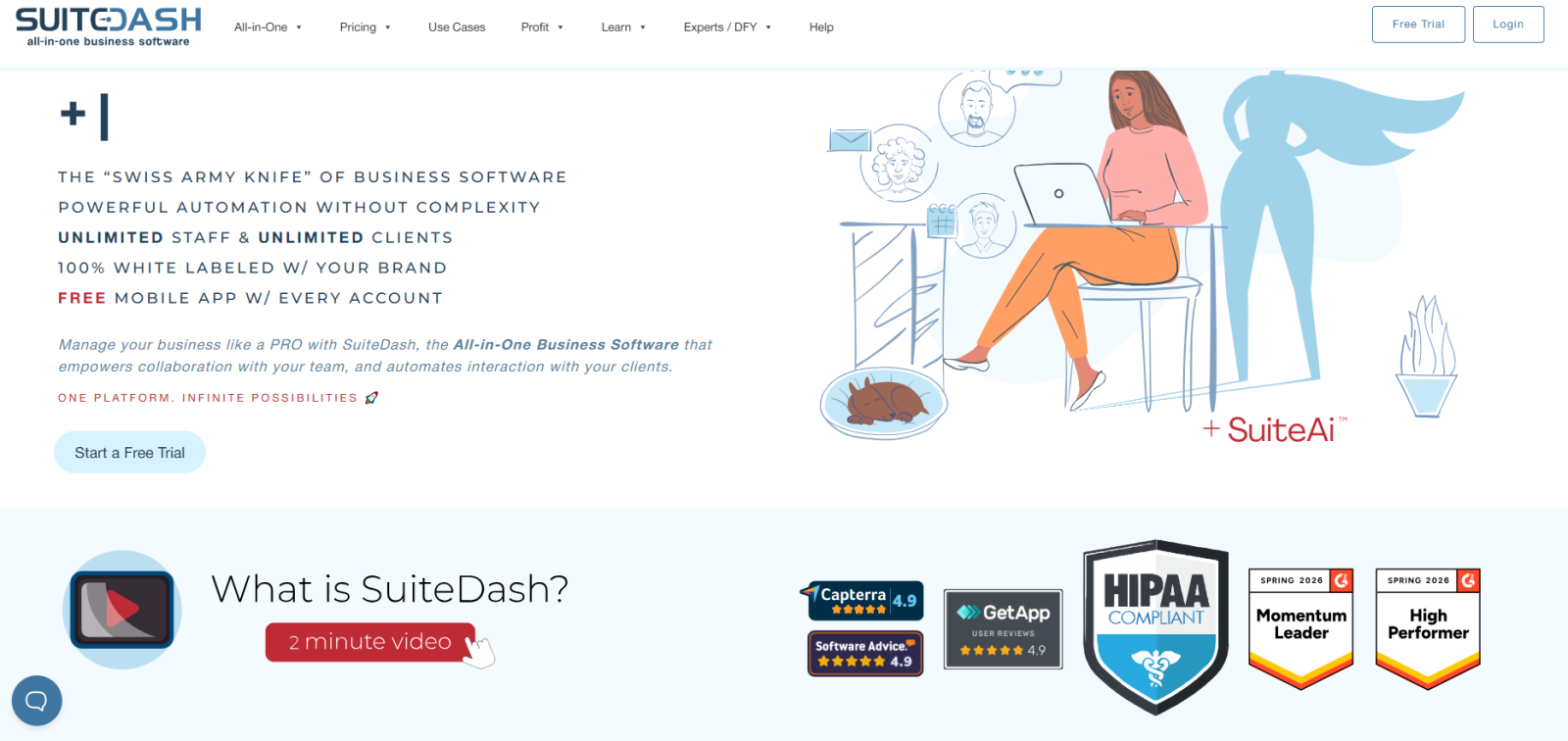

1. What Is Kavout?

Kavout is an AI-driven investment analytics platform designed to help investors make data-informed stock decisions.

Instead of manually analyzing:

-

Earnings reports

-

Technical charts

-

Valuation metrics

-

Market signals

Kavout uses machine learning algorithms to process massive datasets and generate actionable insights.

The platform is best known for its AI Stock Rating system, which scores stocks based on predictive modeling.

2. How Kavout’s AI Stock Rating Works

2.1 The K Score System

At the core of Kavout is its proprietary AI rating — often referred to as the K Score.

The system evaluates:

-

Financial fundamentals

-

Technical indicators

-

Momentum patterns

-

Market sentiment signals

-

Risk-adjusted performance data

Stocks are then scored on a scale that helps investors quickly identify stronger vs. weaker candidates.

Instead of screening hundreds of stocks manually, users can filter by AI score and narrow down potential opportunities in seconds.

If you want to test how their rating engine works in real-time, you can start using Kavout’s AI stock analysis here.

2.2 Machine Learning & Big Data Integration

4

Kavout leverages:

-

Historical stock performance data

-

Real-time market feeds

-

Quantitative financial metrics

-

Pattern recognition algorithms

This allows it to detect signals that might not be visible through traditional analysis alone.

Important note: AI tools support decision-making — they do not guarantee profits.

3. Core Features

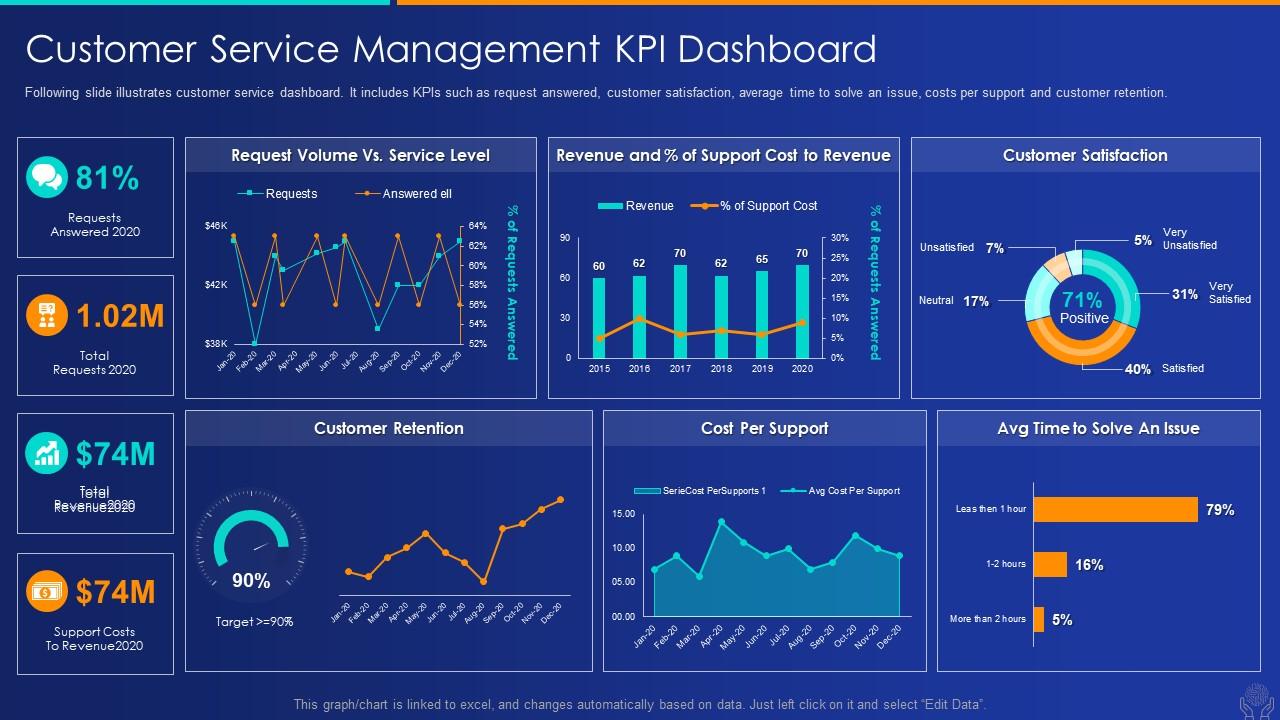

3.1 AI Stock Ratings Dashboard

The dashboard allows users to:

-

View stock rankings

-

Filter by sector

-

Analyze risk scores

-

Compare performance metrics

For active traders, this reduces research time significantly.

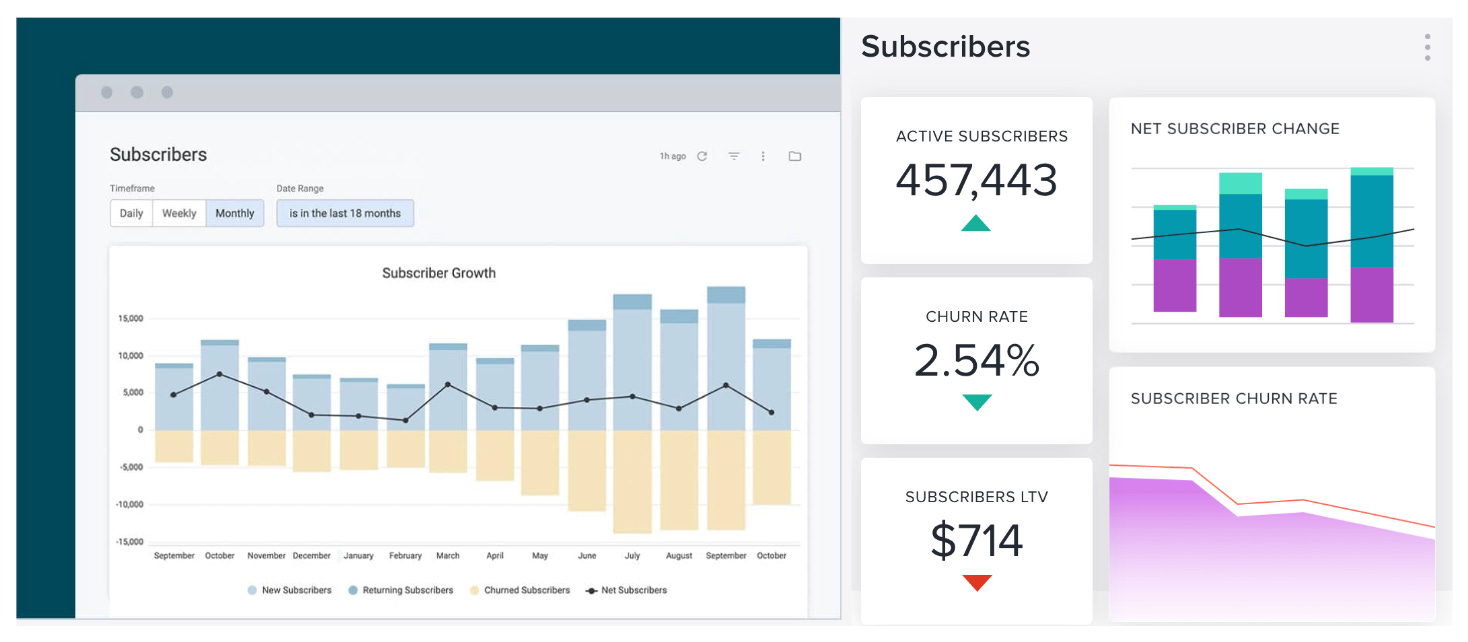

3.2 Portfolio Monitoring Tools

Users can:

-

Track portfolio performance

-

Monitor AI score changes

-

Identify weakening holdings

-

Discover new opportunities

This makes it suitable for both swing traders and long-term investors.

3.3 Market Signals & Insights

Kavout provides:

-

Quantitative insights

-

Market momentum indicators

-

Risk-adjusted performance metrics

-

Data-backed screening tools

If you're serious about systematic investing, you can view Kavout subscription options here and evaluate which plan aligns with your trading frequency.

4. Who Is Kavout Best For?

✅ Data-driven retail investors

✅ Swing traders

✅ Quant-focused investors

✅ Portfolio managers

✅ Investors who prefer systematic strategies

Not ideal for:

❌ Investors looking for guaranteed returns

❌ Fully passive buy-and-forget investors

❌ Beginners unfamiliar with stock market basics

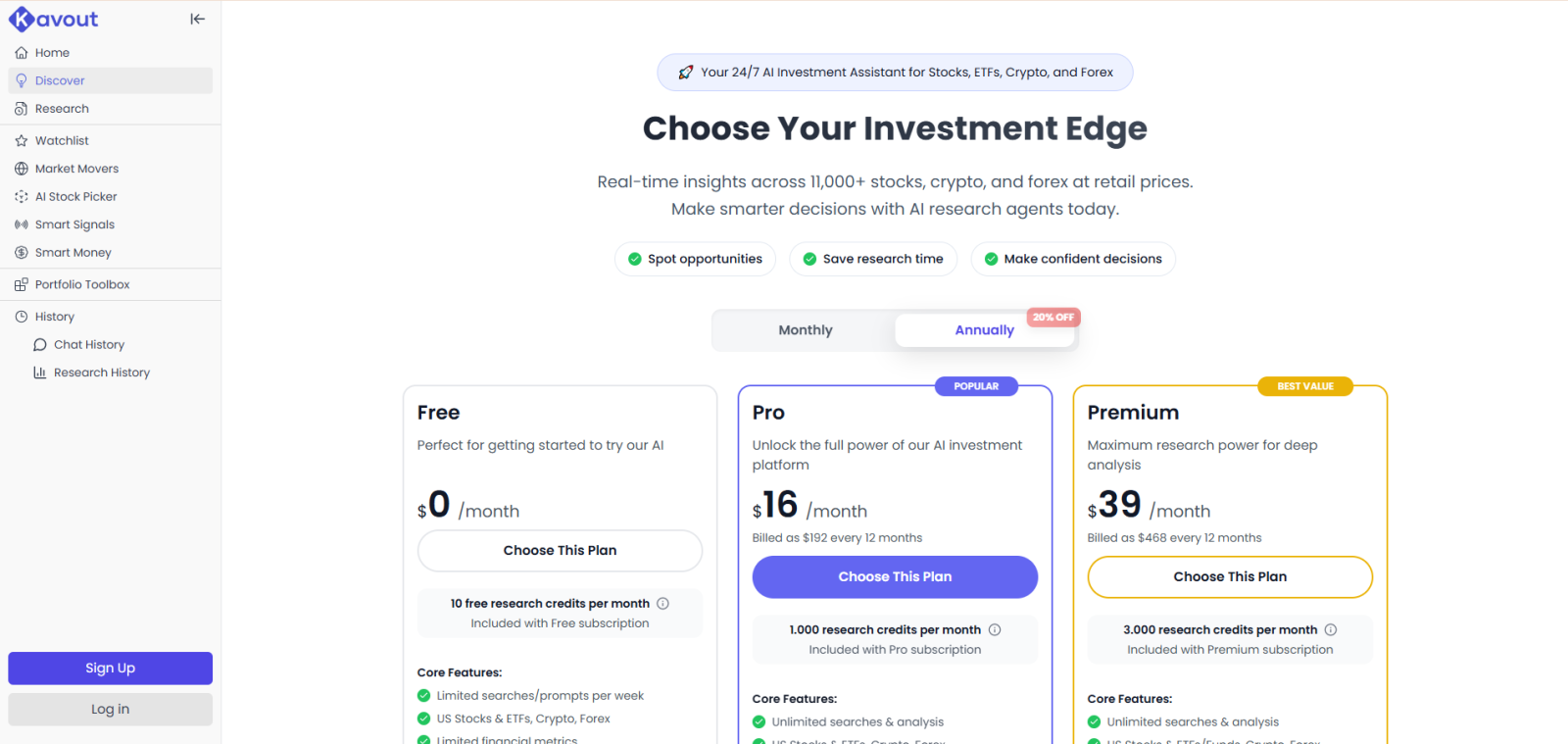

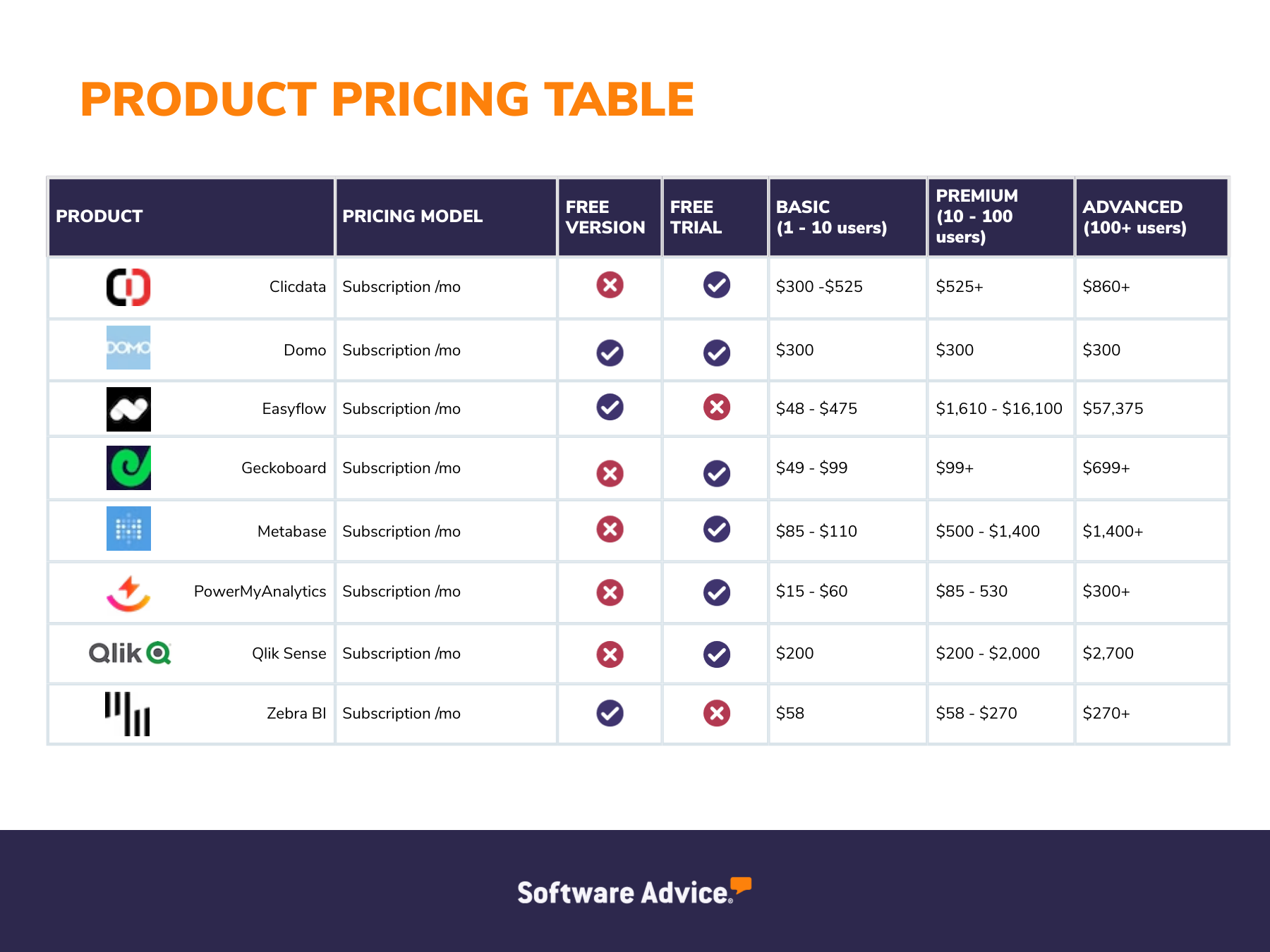

5. Kavout Pricing Plans

4

Kavout offers tiered subscription plans, typically structured based on:

-

Access to AI ratings

-

Portfolio monitoring features

-

Advanced analytics tools

-

Data depth and screening filters

Higher tiers unlock more comprehensive datasets and portfolio tracking capabilities.

Before subscribing, it’s smart to review what’s included in each tier. You can explore Kavout’s pricing structure here to compare plans directly.

6. Pros & Cons

✅ Pros

-

AI-powered stock ratings

-

Data-driven approach

-

Time-saving screening tools

-

Suitable for active investors

-

Portfolio monitoring features

❌ Cons

-

Subscription-based model

-

No guarantees (AI is probabilistic)

-

Requires understanding of stock market fundamentals

7. Is Kavout Worth It in 2026?

Kavout is not a magic money machine.

It’s a decision-support tool.

If you:

-

Value quantitative analysis

-

Prefer systematic investing

-

Want AI-enhanced research

-

Trade actively

Then Kavout can provide meaningful efficiency and insight.

If you expect guaranteed returns with zero effort, no platform can deliver that.

For investors who want structured, data-backed stock selection, you can try Kavout here and review the available plans to see whether the features justify the cost for your strategy.

Frequently Asked Questions

Is Kavout beginner-friendly?

It’s easier than building models yourself, but users should understand basic investing concepts.

Does Kavout guarantee profits?

No. It provides AI-driven insights, not guaranteed outcomes.

What markets does Kavout cover?

Primarily U.S. equities, depending on subscription tier.

Can I use Kavout for long-term investing?

Yes, especially for identifying strong fundamental + momentum stocks.

Is Kavout good for swing trading?

Yes. AI score changes can support active strategies.

Final Verdict

Kavout brings institutional-style AI analysis to retail investors.

Its strength lies in:

-

Data processing power

-

Systematic stock ranking

-

Efficient screening

-

Portfolio oversight

It is best used as a complement to your investment strategy — not a replacement for due diligence.

If you’re ready to explore AI-assisted investing tools, you can start using Kavout’s platform here and determine whether its AI insights enhance your trading process.

RELATED REVIEWS

PagerGPT Review